About Us

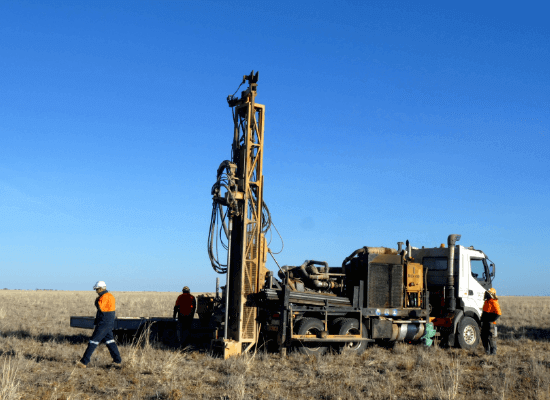

Richmond Vanadium Technology is an Australian minerals development company which is advancing the Richmond – Julia Creek Vanadium Project in Queensland through a Bankable Feasibility Study.

RVT aims to unlock the potential of our world class vanadium deposit to support the global energy transition, and be recognised as a trusted global leader in the vanadium market and a long-term stable supplier of high-quality vanadium.

The Company commenced trading on the Australian Securities Exchange in December 2022.